Investments in the transition from the private sector comprise just under US$5,3-billion. Photo courtesy Anglo American

Pledges in support of South Africa’s Just Energy Transition stand at $11.9 billion, and the country is mobilising additional finance, including grants, to facilitate the shift from fossil fuels to clean energy.

Since the initial $8.5 billion pledged at the United Nations Climate Change Conference in Glasgow in November 2021, referred to as COP26, there have been further pledges by the Netherlands and Denmark. Spain has also committed additional funding towards the transition.

The treasury told Oxpeckers that, so far, it has received €600 million (about $640 million) of the pledges. These are loans of €300-million each from Germany and France that were concluded through the Just Energy Transition Investment Plan (JET-IP) in 2022 and early 2023, to support policy and institutional reforms related to climate change.

“We now have pledges of $11.9 billion, but it’s still a long way from the just under $90 billion [about R1.5 trillion] that will be required over the next five years,” said Neil Cole, financing manager of the JET-IP project management unit.

Concessional loans

Cole said concessional loans make up the highest proportion of the total pledges, at $5.3 billion. A concessional loan, or “soft loan”, is made on more favourable terms than the borrower could obtain in the marketplace. Private investments make up a similar amount.

Just over R530 million of the pledges comprise grants, he said.

Cole said the project management unit (PMU) believes that multilateral development banks, such as the World Bank and the African Development Bank, will also significantly invest in the Just Energy Transition, through grants and concessional loans.

“Included in that group of multilateral development banks is the New Development Bank, otherwise known as the Brics bank, that we have approached as part of our mobilisation of funds,” he said.

The PMU has not set a target figure for the amount of grants to be mobilised, head of the unit Joanne Yawitch told Oxpeckers, but “in principle, the greater the grant amount, the better. Similarly, increased allocation of concessional finance is important to take the JET forward.”

At the recent Africa Climate Summit in Kenya, Environment Minister Barbara Creecy stressed the importance of African countries developing a new financing model that will not increase debt and worsen Africa’s fiscal positions.

“African countries need a new suite of financing instruments, with a set of favourable terms and conditions that are not merely debt generators, or our efforts and actions of mobilising the trillions of dollars required for significantly scaled-up climate action will be actions in futility,” she was reported as saying in an article published by the Mail & Guardian.

According to Cole, the PMU certainly wants to increase the amount of grants that it is going to be mobilising because grants have all kinds of benefits. “It’s a call to the international community, and that call is at different levels. It’s a call at multilateral forums such as COPs and various climate summits that take place,” he said.

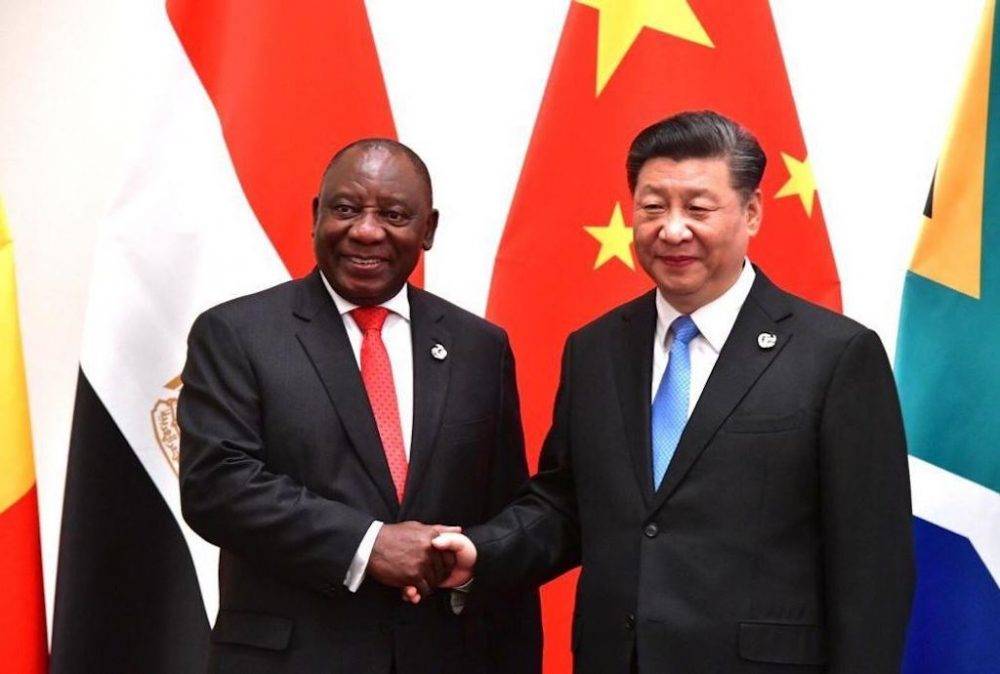

President Cyril Ramaphosa and President Xi Jinping shake on the donation of emergency power equipment worth R167-million and a grant of about R500-million as development assistance. Photo courtesy Government.za

President Cyril Ramaphosa and President Xi Jinping shake on the donation of emergency power equipment worth R167-million and a grant of about R500-million as development assistance. Photo courtesy Government.za

Small and medium enterprises

Economic diversification and participation of small and medium enterprises in the renewable energy value chain need to be financed, Cole said, and the sources of that financing will come from both grants and concessional loans, as well as investments that are going to be made by the private sector.

He said the government is participating in multilateral forums, as well as bilaterally with individual countries. “We recently had the Brics summit that took place in South Africa with very strong commitments from the Chinese government to support the transition and investments in renewable energy,” he said.

The Chinese government pledged a grant of about R500 million for the energy sector during a state visit in Tshwane in August, where President Cyril Ramaphosa hosted his Chinese counterpart, President Xi Jinping.

“South Africa deeply appreciates China’s support in addressing our current energy challenges. This includes the donation of emergency power equipment worth R167 million and availing a grant of approximately R500 million as development assistance,” Ramophosa was quoted in BusinessTech.

Details of this grant are not available, but a memorandum of cooperation between South Africa and several Chinese entities was shared by the ministry of electricity with Oxpeckers. It focuses on enhancing South Africa’s energy security through regulatory reform, infrastructure and technology development, human capital development, and research and development capacity.

It also aims to “promote sustainable energy solutions and diversify South Africa’s energy mix; strengthen bilateral cooperation … to support South Africa’s localisation and industrialisation programme objectives; facilitate knowledge and technology transfer; and encourage investment in the energy sector in South Africa”.

Participant companies from China are listed as “State Grid Corporation of China, China-Africa Development Fund, China Energy International Group, China General Nuclear Power Corporation, China National Electric Engineering Company Ltd, Huawei Technologies Co Ltd, TBEA Co Ltd and Global Energy Interconnection Development and Cooperation Organisation”.

Grants from development partners and multilateral development banks are needed to mitigate impacts of the transition in Mpumalanga. Photo: Ashraf Hendricks

Grants from development partners and multilateral development banks are needed to mitigate impacts of the transition in Mpumalanga. Photo: Ashraf Hendricks

Coal belt

In Mpumalanga, where the transition is being felt most by coal-affected communities, grants and concessional loans will play an important role in benefiting these communities, according to the PMU.

“There are two key sources of financing that we need to turn to mobilise in order to ensure that we mitigate the impact that the transition is going to have on workers in the coal belt and also the communities that were benefiting from having a coal power station or having a coal mine in the area,” Cole said.

“This is why we place so much emphasis on an increase in the contribution in the form of grants, mainly from development partners but also from multilateral development banks. Grants are going to enable us to address some of the ‘just’ components in the JET-IP,” Cole told Oxpeckers.

“We want to be supporting those workers who are transitioning out of the coal value chain and affected communities. And we also want to ensure the plan includes the investments that are required when those communities transition into the new value chain.”

He was unable to say how much of the €600 million received by the treasury so far had been allocated to this mission in Mpumalanga.

Neil Cole: ‘What we’re dealing with now is a five-year plan so we remain focused on the next five years.’ Photo supplied

Neil Cole: ‘What we’re dealing with now is a five-year plan so we remain focused on the next five years.’ Photo supplied

COP28 expectations

According to the treasury, the government will continue its efforts to access concessional financing from international financial institutions, including through climate finance. In 2023-24, the government plans to raise the equivalent of $2.6 billion.

Cole said at COP28, to be held in Dubai from November 30 to December 12, South Africa needs to point out two things, the first being what progress the country is making in the implementation of the JET-IP.

“How and where are we with the implementation? What kind of progress has been made? And also, of the pledges that the international community has made, what progress are we making in terms of how that money is going to be used because in 2024, we have to see the disbursement of those funds.”

The investment plan is a five-year plan that runs from 2023 to 2027, he added. “There’s a lot happening alongside the plan, and we need to consider that the transition is a transition to 2050. But what we’re dealing with now is a five-year plan so we remain focused on the next five years.”

The second issue “is where we join with other African countries and also countries in the Global South, in calling for developed countries to meet the commitments that they had made, both in the form of grants and of climate finance”, said Cole.

It is important that Western countries meet the commitments they made in the past, he said. “I’m sure by the time they get to COP28, they are going to be making new commitments. We certainly want to see them delivering on the previous commitments that they had made.”

Thabo Molelekwa is an associate journalist of Oxpeckers Investigative Environmental Journalism, and a graduate of our #PowerTracker professional support and training programme. This investigation was supported by the African Climate Foundation’s New Economy Campaigns Hub.